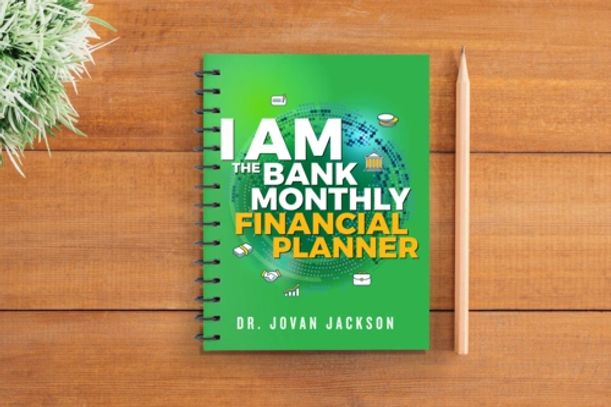

Tired of feeling all over the place with your Finances?

No real system to track and organize your accounts, budget, and goals?

Make Managing Your Finances easy with this simple tool!

Many people have goals of being great stewards over their finances, but struggle to do so because they lack the right tools and systems they can be committed to each month. Resulting in not having a written plan you can follow to Budget, Save, Invest, or Get out of Debt.

You know you should be following a budget or saving more each month but tend to get overwhelmed when trying to track it on your own. Gathering and organizing statements can be overwhelming and you end up having no idea where all the money went at the end of each month.

Well here’s the solution to these challenges…

Your sure to succeed with a little accountability and keeping your goals and tasks in front of you daily or weekly. It’s like having your very own financial Coach in your pocket!

With this planner, you will be that much closer to the Millionaire mindset of managing your money, and you will be confident in sustaining your finances for years to come!

What You Get With this Planner:

- Semi-Annual undated layout so you can start planning at any point in the year

- An accountability system to end procrastination

- Clarify your financial goals with a simple goal planning system

- Reduce overdraft & bank fees by managing your due dates with your pay cycles

- Save money on late fees because you have all due dates recorded in one place.

- See your Debt free plan unfold monthly and know when each debt will be paid off

- Develop an investor’s mindset and wealthy management habits

- No more running out of money before month ends, or “Robbing Peter to pay Paul”

- Improve self-doubt when you cross off every goal

- De-clutter and stay organized with 1 notebook for all your financial plans

Each Month You Can Set and Define Your:

- Top 3 Financial Goals and Tasks required to achieve them so you stay on track!

- Monthly Savings plan to know exactly what you will save and how you will reach your savings goal each month!

- Long-term Savings plan so you will know how each retirement account is performing each month and have money when you need it most.

Eliminate Debt

Eliminate Debt

Eliminate Debt

Debt Elimination plan so you will know the exact month & year you will be Debt Free!!

Build a Budget

Eliminate Debt

Eliminate Debt

A personal Budget (monthly or bi-weekly) so you will know where each dollar went, no more month at the end of money or disappearing acts of cash flow.

Invest Wisely

Eliminate Debt

Invest Wisely

Investments plan so you can track how each investment has performed and/or a plan to acquire new investments.

Bonus Value!!!

Specific tips from Dr Jackson on each page to help you apply the best financial management strategies for each plan.

Like having your very own personal financial coach in your pocket!!!!

Bonus Sections Include

- 12 Money Affirmations to declare over your finances daily

- A section to include all your Insurance Protection plans in one centralized location.

- A section to record your “Wins” for each month to keep you focused and motivated along the way!!!

- A “Last Quarter Financial Checklist” to ensure you are on track with your goals before the year ends

- Ongoing Support via our Private Exclusive FB group to hold you accountable, keep you motivated, and much more!!!

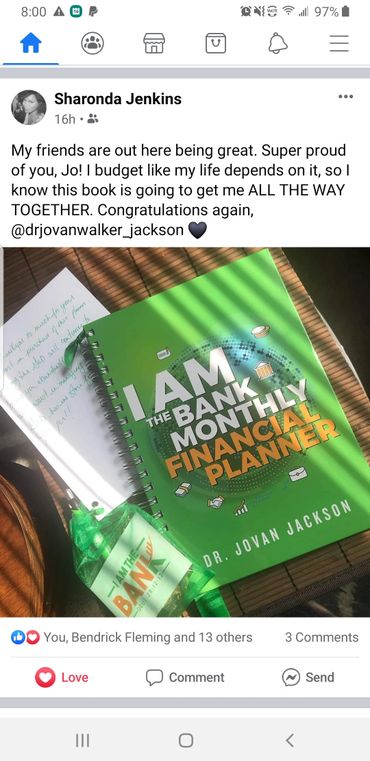

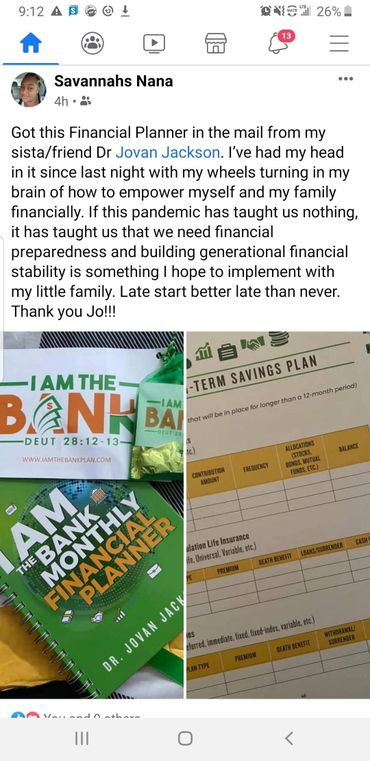

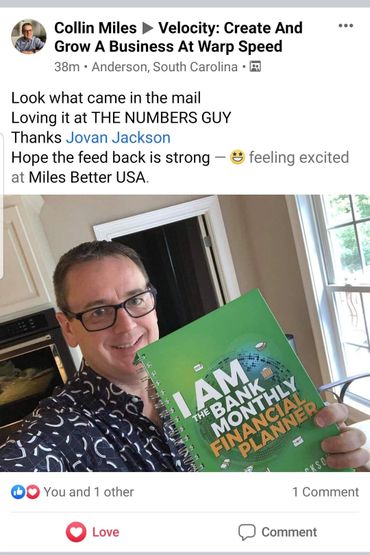

People have Already started being the Bank!!

ABOUT THE AUTHOR, DR. JOVAN WALKER-JACKSON

known as the Financial Coach of Hope, Joavn is a faith filled author, speaker, and licensed financial & Insurance advisor who serves as the president of Good News Financial & Investment Advisors LLC, a registered Investment Advisory

Firm in the state of MD. We develop financial programs and insurance strategies to assist clients in the areas of retirement planning, asset preservation, and long-term care alternatives.

Jovan’s drive and passion to teach financial literacy has led her to become a sought after financial consultant in the Baltimore DC metropolitan area. A native of Baltimore, Jovan has been featured on countless radio shows and taught many workshops for private and government corporations. She also facilitates in spiritual settings through her economic empowerment ministry.

For more info visit www.jovanwalker.net - Copyright ® All rights reserved.

A MESSAGE FROM THE AUTHOR.....

“I developed this planner based on my experiences working with clients helping them to plan out their personal finances. Ive learned what works and what does not. Ive studied clients’ behaviors and what tasks they have been able to execute and take action on. Many planners and journals are overwhelming and put way to many expectations on the average person to fulfill consistently. Which is why their yearly goals they started out with on Jan 1 are usually off track by April 15. This realistic guide provides the necessary areas that one must be focused on to achieve their goals while maintaining their busy lifestyles. The budget worksheet is the exact spreadsheet I use with my clients. Most people haven’t been taught how to create and manage an effective budget to begin with yet we expect them to automatically understand that this is the very foundation of any financial plan. So having the IATB Monthly financial planner will be like having your personal financial coach in your pocket!!!! You will be that much closer to the millionaire mindset of managing your money, and you will be confident in sustaining your finances for years to come!”

~ Dr. Jovan

"This planner is the secret to my success. I use it every day to start off with a motivated mindset, clear priorities, and a focused financial agenda. I absolutely love the sticky note section because I use stickys alot. And the monthly and quarterly WIN section so I can see my progress is truly motivational. Overall, I feel so much more organized and prepared for the expected and unexpected and that sense of security really matters in my life. Everyone who uses it is stunned by their results and progress to stay on track with their financial goals. This is the best planner you’ll ever own."

- Dr. Jovan Jackson

Dr Jovan Jackson - CEO, Good News Financial & Investment Advisors

9500 Medical Center Drive suite 366, Largo, MD, USA

Copyright © 2021 Jovan Jackson - Financial Coach of Hope - All Rights Reserved.

Site Powered by BRAND DESK HOSTING

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.

Join Our Community

If you're ready to feel secure in your financial journey to retirement, then I invite you to join our monthly newsletter for helpful insights, free resources, and answers to your most pressing questions.